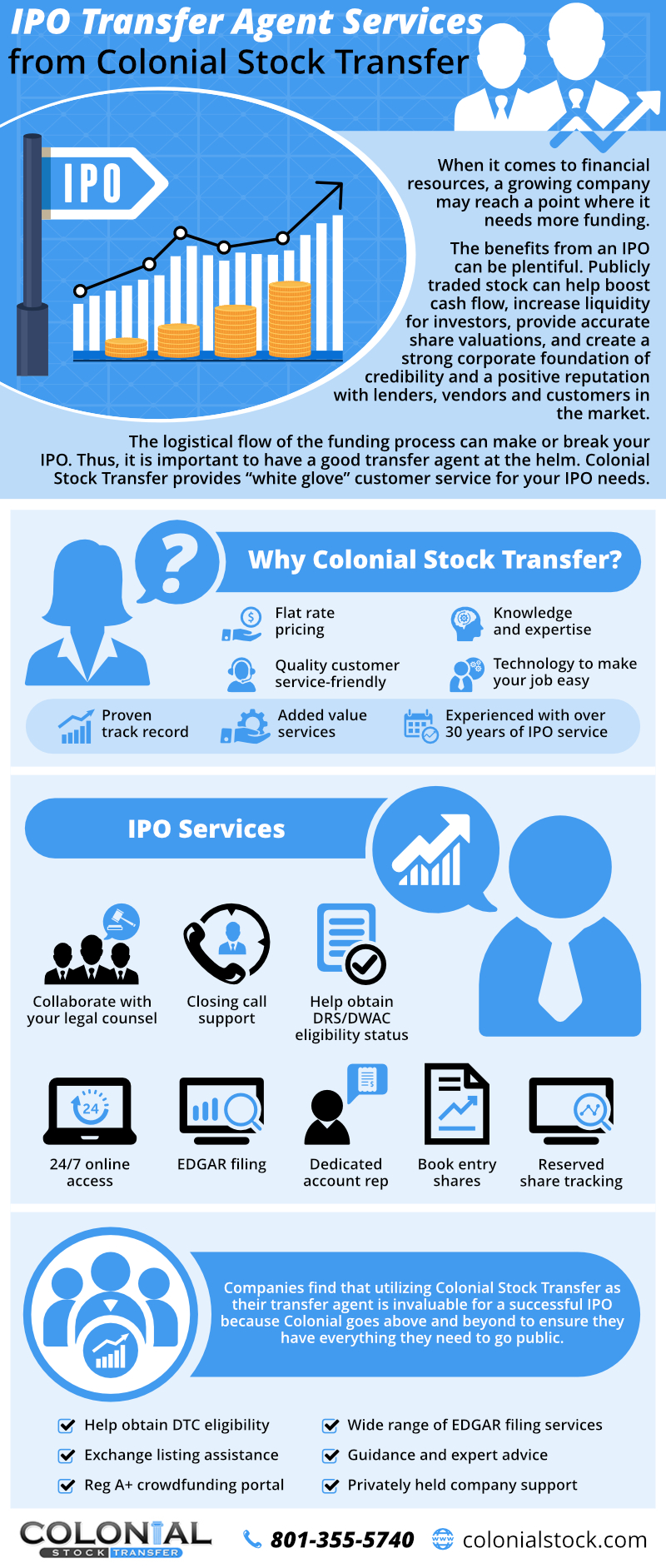

IPO Transfer Agent Services

An initial public offering (IPO) is the first sale of stock that the company issues to the public, commonly referred to as "going public." Most companies complete this process through the services of an IPO transfer agent. The company will need to file Form S-1, F-1, or 1-A with the Securities & Exchange Commission (SEC) and then list previously sold shares for re-sell and/or raise capital through an underwriter simultaneous to their listing on a formal exchange such as Nasdaq or NYSE. Although a private company forfeits some benefits by completing an IPO, going public allows companies to raise large amounts of capital.

Going public enables your company to provide existing investors with more liquidity options. It might also create new and even opportunities for mergers and acquisitions that did not exist as a private company. Additionally, completing an IPO allows companies to advertise their shares to a larger, more diverse group of investors, which may increase liquidity, provide additional financing options, and lead to better networking opportunities all of which can help the business grow more quickly.

Completing an IPO is a complicated process, often lasting several months. Through our IPO transfer agent services, Colonial helps oversee the entire IPO process including:

- Appointment of transfer agency

- Notice of initial public offering

- Shareholder data preparation

- Custodian/paying agent services

- Share issuance and distribution

- Closing call and document support

- Regulatory and market compliance

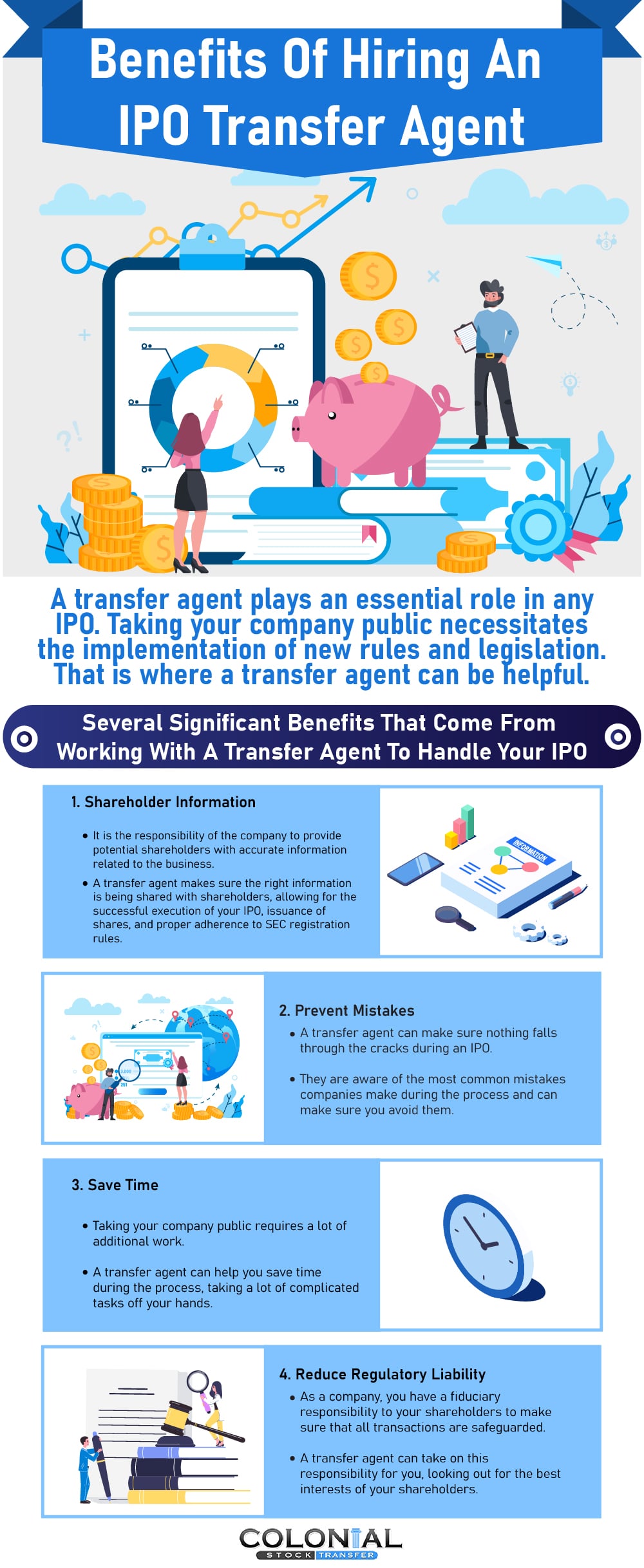

Finding an experienced transfer agent like Colonial Stock Transfer is essential to run a successful IPO. Here are some benefits of using Colonial as your transfer agent for your IPO:

- Stock transfer agency: Colonial Stock Transfer has been an SEC registered transfer agent, in good standing, since its opening in 1987. We ensure that the processing of your IPO will be successful with our personalized and responsive service and over 30 years of experience.

- Offering guidance: We work with your legal counsel to help guide you through complex securities laws and logistics for your IPO including closing calls and meetings with investment bankers.

- DTC eligibility: We can help you obtain DTC eligibility and DRS/FAST/DWAC status.

- Exchange listing: For NASDAQ and NYSE listings, we provide application and advisory support including TA certifications to the exchanges. For OTC listings, we can connect you with a market maker to submit your 15c211 filing.

- 24/7 online access: We provide 24/7 online access to interactive reports for your cap table management needs, shareholder meetings, dividends, employee plans and more.

- Flat-rate pricing: Don't worry about being nickeled and dimed, sign up for our predictable, flat-rate pricing.

- Account manager: We guarantee reliable and quality driven service, and always provide quick responses through phone and email. We also provide you with a designated account manager.

- Book-entry shares: Our services allow your investors to hold shares in book-entry electronic form for DRS or DWAC transfer to the broker.

- EDGAR filing: As an SEC filing agent, we can help you file your registration statement to the SEC in EDGAR and XBRL formats, along with the required quarterly and annual reports following the registration statement's effectiveness.

Colonial Stock Transfer has been registered as a transfer agent in good standing with the SEC since its inception in 1987.

Request Proposal

Contact a sales representative to learn more about our transfer agent services at 877-285-8605.