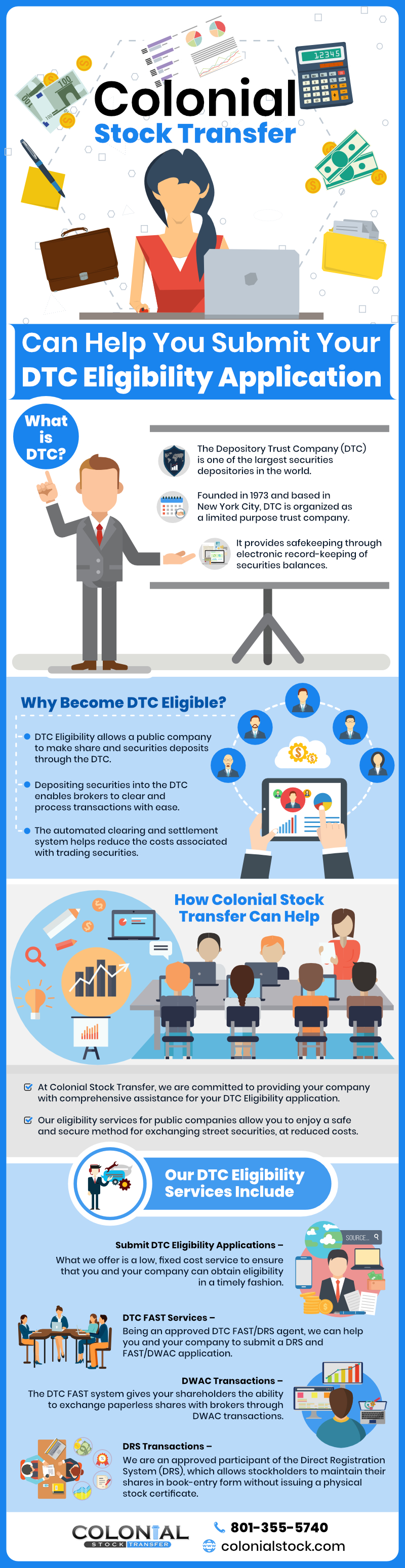

DTC Eligibility Services

Colonial Stock Transfer can assist your company with becoming DTC Eligible. DTC Eligibility allows a public company to make deposits into the Depository Trust Company (DTC) which is the largest securities depository in the world. After a company deposits their securities into DTC, brokers can then clear and process transactions with much less difficulty. This allows issuers the chance to increase liquidity, improve market visibility, and save on broker and clearing fees.

At Colonial, we are committed to providing the comprehensive assistance your company needs to apply for both DTC FAST eligibility and DTC eligibility. With our eligibility services, your company can reduce costs associated with filing as well as enjoying a safe and secure method for exchanging street securities. We offer a low, fixed cost service so that you and your company can obtain the eligibility you need in a timely fashion.

What Happens If You Are Not DTC Eligible?

If you are not DTC eligible, then your shares cannot be transferred between brokerage accounts electronically. That makes it much harder for people to buy or sell shares of your stock. As a result, you may have a difficult time raising the capital you need for your daily operations.

Furthermore, most U.S. based stock exchanges, including the New York Stock Exchange and the NASDAQ, require you to be DTC eligible. Furthermore, the vast majority of large US banks and broker-dealers are DTC participants. If you want to make it easier for investors to trade?your shares in the market with lower fees, you need to be DTC eligible.

Why Should You Become DTC Eligible?

There are several?benefits of becoming DTC eligible. They include:

- If you become DTC eligible, your shareholders can?transfer and deposit shares more easily with brokers.

- If you upgrade your standard DTC eligibility to be FAST/DWAC eligible, you allow for the electronic deposit and withdrawal?of shares. Instead of your investors waiting weeks for their shares to hit their portfolio, it will only take a few hours, keeping your institutional investors?happy.

- FAST/DWAC eligibility allows you to save money by eliminating?physical certificate printing, overnight courier service, and lost certificate fees with your transfer agent.? Your shareholders can also save money on broker deposit fees.?

- You will have an easier time getting your stock listed on stock exchanges including OTC Markets?because you are DTC eligible.?

For all of these reasons, you should apply for DTC eligibility.

What Is Required To Be DTC Eligible?

There are several examples of documents you may need to produce with the help of your transfer agent and broker-dealer to become eligible. They include:

- Include an offering document or registration statement such as an S-1, Form 10, 1-A, etc.

- Your broker-dealer may need to fill out an eligibility questionnaire.

- Your broker-dealer will provide a DTC Letter of Representation.

- DTC may also request a rider, which is typically required only for Reg S issuers.

- If you are applying for FAST/DWAC eligibility, your transfer agent will need to apply for you.

To streamline the process and maximize your chances of being approved, you should work with Colonial Stock Transfer.

You need to minimize your chances of rejection, and there are several common reasons why DTC might reject an application. These include:

- History of late filings with the SEC.

- History of several name changes or reverse splits in the past few years.

- Your broker-dealer will provide a DTC Letter of Representation.

- Lawyers, accountants, or stop promoters on your registry that have a history of being investigated by the SEC.

- History of being involved in a pump and dump scheme, a spam campaign, or fraudulent activity.

Depending on the size of your company, you may not even realize that you have a paper trail tying you to these activities. It is also widely known that the DTC retains the right to deny a company access to DTC services without providing a reason for denial. That is why you need to work with a company that has a lot of experience working with the DTC.

A Colonial Stock Transfer, it would be our pleasure to help you become DTC eligible. A member of our team will work with you closely, streamlining the paperwork to maximize your chances of approval. To learn more about how we can help you, contact us today to speak with our team.

We can submit your application for DTC Eligibility for your company or give us a call at (877) 285-8605.

DTC FAST Services

FAST allows shareholders to submit book-entry/paperless shares via DWAC and DRS to brokers. Colonial is an approved FAST/DRS agent. We can help your company submit a FAST application today at no cost. Visit DTC FAST Services

DWAC Transactions

Utilizing the FAST system, shareholders have the ability to send their shares between the broker and transfer agent through a DWAC transaction. Visit DWAC Services

DRS Transactions

The Direct Registration System (DRS) allows stockholders to maintain their shares in book-entry form without the need for issuing a physical stock certificate. We are an approved DRS participant. Visit DRS Services