Stock Option Tracking Software

Colonial is the leading provider of secure web based software solutions to help companies manage and account for stock based compensation. Our stock option tracking platform monitors and tracks all activities that are related to employee stock options. In addition, our software has the capability to track all other equity instruments in real time for both private and publicly traded companies. Stock option tracking is not a standard part of our typical transfer agent services. However it is an additional solution for executives to better manage their stock.

Our option and award tracking software includes:

- Separate optionee online access portal with individual statement viewing

- Employee and broker connected interface

- All classes of warrants and options, incentive and nonqualified, and other awards such as Restricted Stock Units & Awards (RSU/RSA) phantom units

- Multiple vesting schedules

- Complete optionee record keeping

- Customized reports

- Immediate access to all records and trade activities

Our software system is a full service solution for managing and tracking stock options. We offer the ultimate in security with software that utilizes 128-bit data encryption. In addition, Colonial?s stock options tracking program is regularly backed up on a daily basis to protect against computer and equipment failure. Our cloud software is used by more than a thousand public and private companies. Contact us to find out more about our option and equity tracking software today.

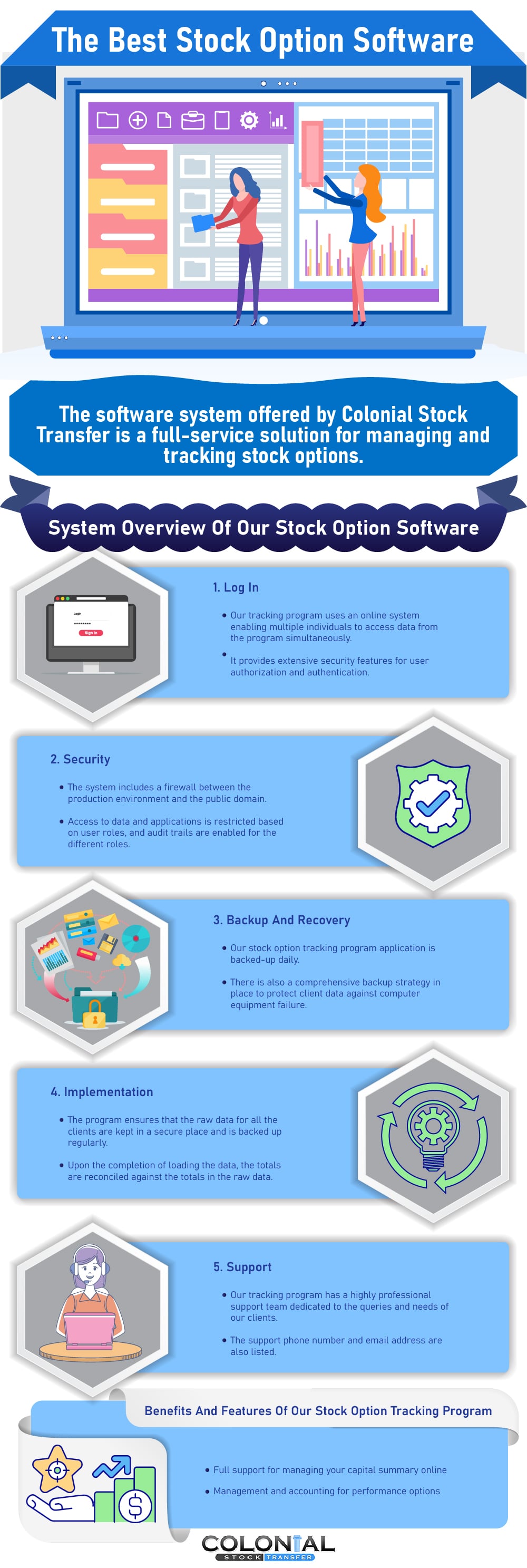

System Overview

Log in: Colonial's stock option tracking program uses a single-sign-on system, which enables multiple individuals to access data from the program simultaneously and in real-time. The data being accessed will depend on the user role, which could be an administrator, an HR manager, an auditor, a broker, or an employee. In addition, Colonial's stock option tracking program keeps track of the complete access logs for different roles, and provides extensive security features for user authorization and authentication.

Security: Colonial's stock option tracking program’s network connectivity is encrypted using 128-bit data encryption, and there is a firewall existing between the production environment and the public domain. Access to data and application is restricted based on user roles, and audit trails are enabled for the different roles. In addition, all employees of Colonial's stock option tracking program have signed the non-disclosure agreement and the privacy agreement.

Backup and Recovery: Colonial's stock option tracking program application is backed-up on a daily basis, and a comprehensive backup strategy is in place to protect client data against computer equipment failures. Moreover, the backup media is stored in an off-site location.

Implementation: Colonial's stock option tracking program ensures that the raw data for all the clients is kept in a secure place and is backed-up regularly. Once the data is received, it is thoroughly analyzed, and upon the completion of loading the data, the totals are reconciled against the totals in the raw data.

Support: Colonial's stock option tracking program has a highly professional support team dedicated to the queries and needs of our clients. The support phone number and email address are listed to the right.

Benefits and Features

Colonial's stock option tracking program can perform all the functions associated with the accounting, management and administration of employee stock options including, but not limited to:

- Automatic loading of stock prices and interest rates

- Automatic calculation of the volatility

- Automatic calculation of the Black Scholes and the Binomial Valuation Values

- Full support for options, restricted shares, convertible debentures, warrants, performance options, SAR's, Deferred Share Units, consultant options and Phantom Shares

- Full support for both uniform and non-uniform vesting schedules

- Full support for evergreen plan calculations

- Automatic generation of all the disclosures needed for the quarterly and annual disclosures

- Automatic generation of grant letters and employee option status letters

- Support for downloading all the data into Excel

- Full Support for the detailed diluted number of share calculations based on the Treasury Method

- Full support for all types of corporate actions

- Full support for all types of vesting and expense acceleration and deceleration

- Full support for changes in strike prices

- As a web-based application, you can get your employees to have direct access to the system where they would be able to see the status of their own options, and to enter their requests for exercising the options. Many companies consider this as an employee benefit.

- A fully web-based application which would allow you as many users as you want to access the system.

- Full support for managing your capital summary on-line.

- Full journal entries and the justification for them.

- Calculations for the expected term of the options based on historical data.

- Calculations for the forfeiture rates based on historical data.

- Management and accounting for performance options.

- The true-up and true-down adjustments associated with changing the forfeiture rates on a periodic basis.

- Management and accounting for variable accounting grants (such as liability-type instruments and consultant options)

- Automatic true-up and true-down adjustments associated with changing the performance criteria of performance options.

- The true-up adjustments associated with changing the terms of existing options.

Administration

Administrators are able to log onto the program at any time to access and change their data from any web browser. Our program keeps track of stock grants, exercises, forfeitures/cancellations, employee types, department blackouts, and any calendar settings.

Our Option Vesting and Amortization feature creates the vesting and amortization schedule automatically based on the setup of what the respective administrator chooses:

- Daily, Monthly, Quarterly, Semi-Annual, or Annual

- Straight-line

- Accelerated/Graded

- One-Entry

- Front End/Back End

Option Expiry feature supports any expiry/cancellation/forfeitures:

- Natural Expiries

- Vested Expiries

- Unvested Expiries with or without reversal

- Unvested Expiries with or without future expense cancellations

Our Option Exercises feature supports both regular cash and cashless exercise types:

- Regular Certificate/Cash

- Same Day Sale, through any broker of your choice

- Surrender to Cover

- Buy Back, allows you to surrender all your shares for intrinsic value

Our Option Awards feature supports separate registries for all the following award types:

- Incentive Stock Options (ISO)

- Non-qualified Stock Options (NSO)

- Warrants

- Restricted Shares

- Equity Settled Share Appreciation Rights

- Cash Settled Share Appreciation Rights

- Performance-based Stock Awards

Our Advanced Features support advanced option activities such as:

- Departmental Black-out Period Setups

- Vesting and Expense Acceleration

- Expense Acceleration

- Vesting Deceleration

- Option Re-pricing/Modifications

- Performance Options Setup and Expensing

Our Option Status and Summary provides a summary of different award status both for the option pool and the individual option holders. Below each summary is a detailed drilldown including individual grants, exercises, and cancellations.

Corporate Actions feature supports automation for all corporate actions:

- Stock Dividend

- Stock Split

- Consolidation

Multi-national feature supports option administration for multi-national entities:

- Multinational Interest Rate Listings

- Foreign Exchange Rate Registry

- Differentiation of Reporting and Exercise Currencies

Employee Notifications are automatically generated on company-specific letterhead, through your chosen notification system:

- Grant Agreement Letter

- Option Status Letter

- Exercise Confirmation Letter

- Grace Period Notification Letter

Valuation and Expensing

Colonial's stock option tracking program provides both valuation and expensing methods that fully comply with the guidelines of CICA 3870 and FAS123(R).

Valuation: Supports the automation of option valuation for both Black-Scholes and Lattice/Binomial Model. For option valuation, the Administrator only needs to enter a few essential parameters such as the grant date, the expiry date, and the strike price, everything else such as the price of the underlying securities, interest rates, volatility, and dividend are all populated automatically by the system.

Forfeiture Rates: Provides guidance on historical forfeiture rates based on company-specific history on forfeitures; and keeps track of forfeiture rate updates and creates expense true-ups according to the parameter changes.

Time-to-Expiry: Provides guidance on historical Time-to-Expiry factors based on company specific history on expiries; and keeps track of Time-to-Expiry factor updates and creates expense true-ups according to the parameter changes.

Amortization: Supports the automation of amortization transaction entries for any types of amortization schedules.

GL Entries: Generates journal entries automatically for all types of accounting transactions (e.g. Stock-based Compensation Expense, Contributed Surplus, Share Capital Stock, Share Capital Options, Cash, etc.)

Variable Accounting: Automates the periodic and vesting true-ups for Consultant's Options (including both the periodic re-valuations and the corresponding expense adjustments.

Reporting and Disclosures

For U.S. Reporters, Colonial's stock option tracking program provides FAS123(R) compliant expense values, notes and proxy disclosures, and FAS128 compliant share dilution report.

For International reporters, Colonial's stock option tracking program provides IFRS-2 compliant option expense, reporting and disclosures, and IAS-33 compliant share dilution report.

10K/Q Disclosures: Automates the reporting of 10K/Qs Fillings.

- Departmental Expense Breakdowns

- Weighted Average Disclosures

- Unrecognized Compensation Costs

Common Notes Disclosures: Automates the reporting of Common Notes Disclosures:

- Option Breakdown Disclosures

- Continuity Schedules

- Option Valuation Assumptions

Proxy Disclosures: Automates the reporting of Officers? and Directors? Positions.

- Officers and Directors Granted and Acquired Options

- Officers and Directors Exercised Options and Aggregate Value Realized

- Officers and Directors Expired Options and Aggregate Value Expired

Share Dilution: Calculates automatically the diluted number of shares using the treasury method (compliant with FAS128).

- Full registry of all types of share transactions

- Automatic calculation of TWA ending share balance

- Automatic calculation of incremental shares

- Automatic calculation of quarterly and year-end diluted number of shares

Capital Summary: Automates the reporting of Ownership Percent and stock ledger.

- Both Table and Graphic views of employee share status and ownership percent

- Detailed drill down of individual employee share transactions